Our financial advisor clients say that their prospects often ask them exactly what it is that they do for them.

You might be caught off guard or give inconsistent responses that don’t match up with the value you bring to the table.

Want to show your value in a clear, consistent, way that is easy to understand?

The Unique Service Model could be the answer.

What is the Unique Service Model?

Your Unique Service Model explains what you do for your clients on a single sheet of paper.

This is something we learned from Taylor Schulte, one of the founders of the Advisor Growth Community, host of the Stay Wealthy podcast and the Experiments in Advisor Marketing podcast, and founder of Define Financial.

We’ve since been able to build on the model he showed us and have customized it for other clients.

If you’d like help with creating your Unique Service Model, click here to visit our contact page and tell us about your project.

How the Unique Service Model Works And What It Includes

Financial planning can sometimes be hard to explain and difficult for your prospects or clients to understand.

The Unique Service Model puts amorphous “financial planning” into words people can understand, and clarify the value you offer in a simple one-page diagram.

This document gives prospective clients a 30,000-foot overview of what you do for them and where you’re taking them.

The Unique Service Model works as a visual aid or PDF you can use during the sales or discovery process.

Included in the Unique Service Model are typically two things:

- The client Onboarding Process / Timeline.

- And the Core Planning / Ongoing Planning areas.

Let’s look at some examples.

Example #1: Taylor Schulte – Define Financial

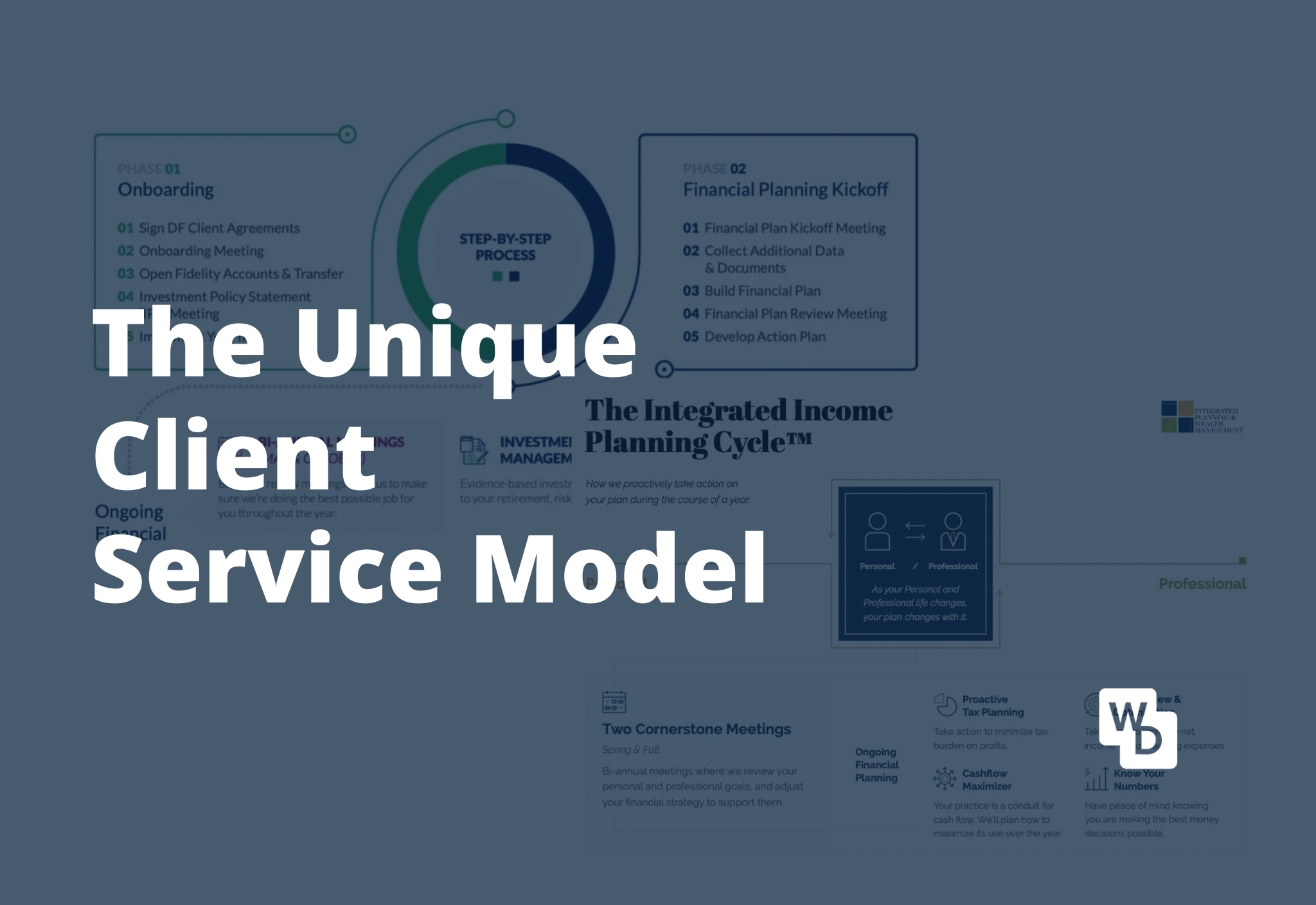

Taylor Schulte’s Unique Service Model (USM) document contains the client onboarding part (the top half of the document) and the Unique Service Model part (bottom half of the document).

His onboarding process is broken up into two phases

- Onboarding

- the Financial Planning Kickoff (which is part of his USM).

Next, the ongoing financial planning portion.

There are two parts to this service model:

- Bi-annual meetings that happen twice per year — these are opportunities to catch up with what’s going on in the lives of your clients and adjust their plan accordingly.

- Ongoing planning – regular touchpoints, services to do throughout the year on behalf of your clients.

Taylor has bi-annual meetings in May and October. And then he has his ongoing planning – investment management, charitable giving, tax and estate planning, insurance planning, and retirement planning.

His USM leaves no room for doubt or confusion! Pretty sweet, huh?

Example #2: Adam Cmejla – Integrated Planning and Wealth Management

Although there are some other differences between Taylor and Adam’s Unique Service Model, but the concept is the same. The main difference is that Adam’s USM does not include his onboarding process.

Adam’s clients are typically optometrists in private practice. He is the host of the 20/20 Money podcast and owner of Integrated Planning and Wealth Management, so to stay on brand we titled his Unique Service Model process the “Integrated Income Planning Cycle™”.

Adam was frequently asked by his prospects, “What does it look like to work with you on a day-to-day basis?”

We’ve explained the benefits of having a Unique Process before, and we summarized the Integrated Income Planning Cycle™ this way: “how we proactively take action on your plan during the course of a year.”

If you’d like help with creating a Unique Service Model, click here to visit our contact page and tell us about your project.

Adam has two cornerstone meetings that happen in the spring and the fall. We summarized the purpose and benefits of the meetings in one sentence (review financial goals and adjust financial strategy).

And then there’s a section for ongoing financial planning.

What you need to know is that there are probably things you do that you don’t necessarily need to mention in your Unique Service Model. When creating your own USM, the idea is to summarize and condense what you do and demonstrate the highest value you provide.

You want to prioritize the information that is going to paint the picture of what you do for your clients. You don’t need to go into a lot of detail. Focus on benefits and the big picture things.

How to Create an Effective Unique Service Model

There are a few key things we look at whenever making an effective Unique Service Model:

- An easy-to-understand diagram that visually illustrates the value you bring. Your client can see all the benefits and value you bring to the table as an advisor.

- Create intellectual property. If you want your service model to stand out from your competition, you need intellectual property. The Unique Service Model is your opportunity to create exactly that.

- Create a model that complements your Unique Discovery Process. This helps you create a consistent experience and sets your client relationships up for success.

Final Thoughts

In summary, your Unique Service Model is a one-page document clearly showing how you help your clients. As your intellectual property, it helps you stand out from your competition and explains the benefits you offer to your clients in a concise manner.

Whenever your prospects or clients ask you how you can help them, you can show them your USM, which visibly demonstrates your value. And that’s how you knock it out of the park!

If you’d like help with creating a Unique Service Model, click here to visit our contact page and tell us about your project.